Article Body

The Surge of the Global solid-state battery market: An In-Depth 2025–2035 Outlook

Introduction

It is fair to say that the energy storage world is changing rapidly, with solid state batteries beginning to take center stage as a key technology.

According to NextGen Intelligence Stats, the global Solid State Battery Market is poised to create impressive growth, with a compound annual growth rate (CAGR) of 23.3% from 2025 (US$ 1071.2 million) to 2035 (US$ 30612.8 million).

This article analyzes the key trends, segmentation, tactics, drivers and regional insights of this high-growth technology, and provides clear, human-centered market intelligence for investors, businesses, and analysts.

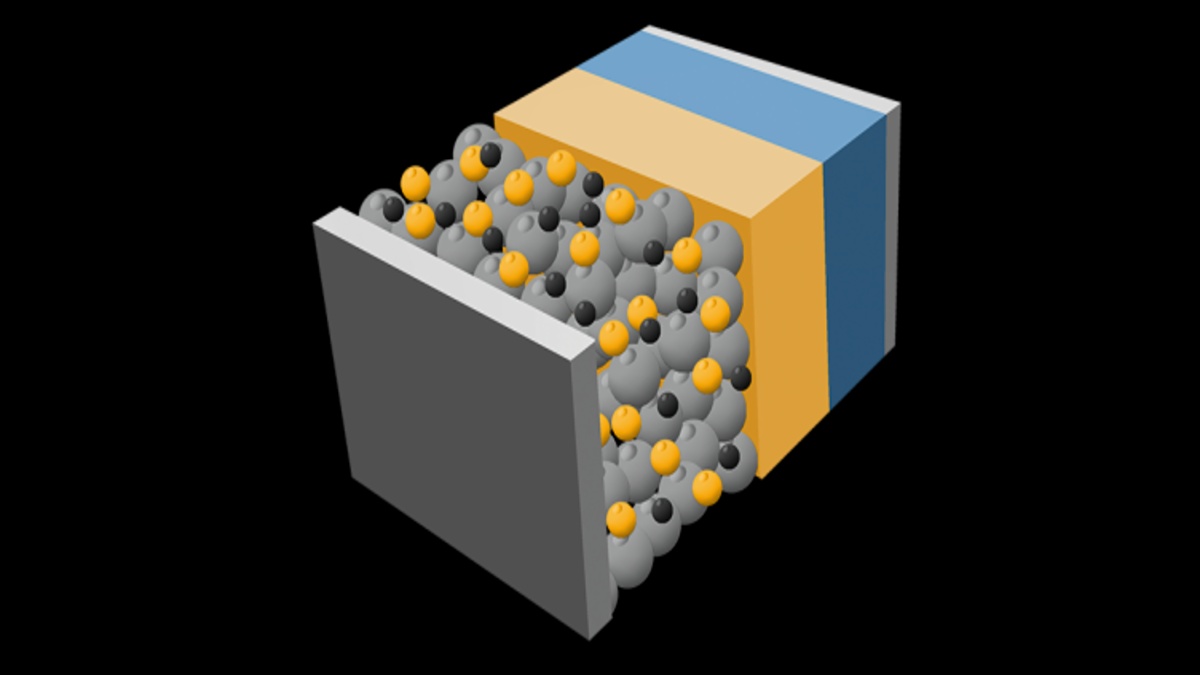

What Sets Solid-State Batteries Apart?

In replacing the flammable liquids or gel electrolytes in regular lithium-ion batteries with a stable solid electrolyte, solid-state batteries provide a safer, longer-lasting, and denser energy storage solution. They are changing industries such as automotive, consumer electronics, and industrial energy storage with solutions to:

• SAFETY : Reduced fire and explosion risk from the elimination of flammable liquid solvents.

• HIGH ENERGY DENSITY : Ability to pack more energy into less space, which is critical for electric vehicles and mobile devices focused on longer run times.

• DURABILITY : Increased resistance to capacity fade, which means longer usable lives, less maintenance, and more value.

• FASTER CHARGING : Ability to meet the modern consumer's demand for quick, reliable access to energy.

Market Size and Outlook

The proprietary data from NextGen Intelligence Stats shows the solid-state battery market has a significant growth trajectory ahead. The growth from $ 1071.2 million in 2024 to $ 30612.8 million by 2035 does not only represent continued innovations in solid-state battery technologies, but in the proven transition of them to commercially viable large-scale manufacturing and application.

This CAGR of 23.3% shows the battery segment of energy markets as among some of the fastest growing in the next decade, and to represent something among the upper levels of growth by market rate.

Significant growth drivers

• Electrification of Mobility - The shift to electric vehicles (EVs) - in particularly passenger vehicles, bicycles and small mobility solutions - is a main growth driver. Solid-state technologies are a key part of the strategy for car manufacturers, as they seek to provide more range, safety and faster recharging for EVs.

• Renewables and Storage - The ongoing move towards renewable energy by the energy sector, is driving ever greater demand for resilient batteries, particularly for grid balancing, home power, and remote or off grid operation in different regions.

• Consumer Devices - The long usage life and safety aspects for next-gen smartphones, wearables, and portable electronic devices drives the industry-wide demand for solid-state batteries.

• Industrial & Medical Applications - As reliable and compact energy storage is needed for the development of the Industrial IoT space, remote monitoring and the medical device space, battery storage will continue to be accelerated into new applications.

segmentation: A Structurally Robust Analysis

The NextGen report "Global Solid-State Battery Market" segments the solid-state battery industry by product, by capacity and by application. By being able to report on a standard basis, we believe this format is essential for buying decisions made by our clients and product development/sourcing strategy.

By Product

• Portable Solid-State Batteries: Mobilizing the demand for lightweight, mobile, and flexible energy sources in consumer and specialized sectors.

• Thin Film Solid-State Batteries: Being used in wearables, micro-systems, and every application requiring small-scale integration.

This segmentation enables stakeholders to design solutions based on their specific operational industry.

By Capacity

|

Capacity Category |

Use Cases |

|

Below 20 mAh |

Medical implants, environmental sensors, microdevices |

|

20 – 500 mAh |

Smart cards, small consumer gadgets, tracking devices |

|

Above 500 mAh |

Electric vehicles, stationary storage, industrial use |

By Application

• Industrial: Factories/supply chains that can leverage solid-state batteries in relation to operational stability and unbroken operation.

• Automotive: The most active segment as EV adoption rises in every corner of their world and many governments offer subsidies to assist EV purchase. Solid-state solutions can deliver improved range, safety, and most importantly charging times to overcome conventional battery limitations.

• Consumer Electronics: smartphones, smart-watches, tablets, and much more newly emerging XR (extended reality) hardware that demands a simultaneous reduction in size, improvement of safety, and an increase in capacity (or length of operation).

• Energy Storage: Some quick scaling opportunities already exist in grid scale energy systems, home energy storage, and decentralized micro-grids.

• Other Applications: wearables, medical implants/devices, military / defense specialty products.

regional analysis: Where Growth is Accelerating

Asia Pacific, The Continent of Leadership

The Asia Pacific region is the largest scale manufacturing region and the fastest rate of technology adoption. According to NextGen Intelligence Stats these include:

• Manufacturing powerhouses - China, Japan, South Korea, and India are home to large battery manufacturers and suply chain integrators.

• Consumer electronics - Global brands headquartered in this region are creating demand for high-performance, reliable batteries.

• Substantial policy support - The region has levers for EVs, R&D funding, and renewables integration into economic growth and battery investment momentum.

• R&D continues to grow - Partnerships across government, universities, and the private sector are accelerating technology development, focused on rapid commercialization.

North America: Tech and Auto Innovation

As a market led by the USA and Canada, North America is a suitable market for battery adoption based on:

• Tech leadership - Early adoption of EVs versus market adoption, smart infrastructure adoption and energy storage technology commercial readiness emanating from Silicon Valley or various automotive home bases.

• Public funding - Strong sub regional support from policymakers for all green technology/ domestic supply chain achievement that positively influences investment acceptance.

• Partnerships - Collaborative efforts between manufacturers and national labs are decelerating academic and production efforts.

Europe: Policy and Manufacturing Powerhouse

Europe offers strong growth from the deployment of:

• Government bottom lines - Mandating emissions reduction expectations and offering fiscal incentives for e-mobility.

• Automotive history - The region is home to major automotive manufacturers aggressively funding the transition to all-electric fleet ambitions.

• Sustainable reality - Renewables projects and grid improvements have ramped up demand for battery storage.

Dive Into Our In-Depth Market Analysis: https://nextgenintelligencestats.com/solid-state-battery-market

Trend Highlights: What’s Shaping the Market

Increased Investment in R&D

• Leading manufacturers and start-ups are investing heavily in material science and scalable manufacturing processes.

• AI and machine learning are accelerating the design process for batteries, optimizing performance, and providing custom battery solutions.

Collaborations

• A number of successful products or solutions result from partnerships between technology companies, car manufacturers, material science companies, and government agencies.

• Collaboration is helpful to reduce supply chain, cost, and speed-to-market challenges across a spectrum of industries.

Scaling Manufacturing

• Industry participants struggle to scale from pilot plant level to beyond full production.

• Investment into advanced manufacturing facilities and getting more of a manufacturing process automated are necessary to meet the expected exponential growth of demand in the auto and stationary storage space.

Sustainability & Regulation

• Solid-state batteries ultimately enable the world to move to carbon neutral by facilitating deep electrification across mobility and power infrastructure.

• Regulations are increasingly driving batteries that minimize environmental impact through safety, recyclability, and energy efficiency and will only boost this market.

Competitive Landscape and Future Opportunities

The competitive landscape is characterized by strong commitment from the major battery players, the development of emerging technologies, and existing industry players shifting to solid-state pathways. NextGen Intelligence Stats proprietary research has tracked significant investments by major players including:

• Investment in IP and patent portfolio :To clearly provide value from their technology lead

• Gigafactory investment : To achieve cost-effective large scale manufacture

• Material sourcing and circular economy initiatives : To guarantee future sustainability and price stability

Future Opportunities

• Automotive Electrification: With automakers advancing next-generation EVs, the demand for solid-state batteries climbs even higher.

• Grid Resilience: Recent power infrastructure modernization means that solid-state batteries will play a major role in the most sophisticated smart grids.

• Portable Technology: The safest highest-energy, naturally vernal batteries will make the Next Generation of consumer electronics.

• New & expanding applications: Medical devices, aerospace and defense are ongoing emerging opportunities with growth expansion into excellent automotive drives-testing and prototyping.

Here is a list of some key players in the global solid-state battery market based on market trends and proprietary market intelligence as outlined by NextGen Intelligence Stats:

Major Players and Stakeholders in the Solid-State Battery Market

• QuantumScape Corporation

Pioneers in solid-state battery technology focused on automotive applications with unique solid electrolyte technology.

• Samsung SDI

One of the largest battery producers continuously investing in solid-state technology and technology development for consumer electronics and electric vehicles.

• Toyota Motor Corporation

The first automakers to significantly invest in and pilot solid-state batteries in high-volume electric vehicle production.

• Solid Power Inc.

Provides scalable solid-state battery development and production capabilities aimed toward the automotive and energy storage use cases.

• Panasonic Corporation

A verified long-term battery technology innovator. Developing solid-state betteries for future integration into next-generation electric vehicles and portable devices.

• LG Energy Solution

A diversified battery supplier currently working at full speed on research and development into solid-state battery technology development and manufacturing technologies.

• Ilika plc

UK-based advanced materials company bringing-to-market thin-film solid-state batteries for use in the IoT and wearable technology sectors.

• Blue Solutions (part of Bolloré Group)

Focused on industrial use and stationary applications with several demonstrations of solid-state technology.

• BMW Group

Actively partnering with battery innovators to develop solid-state cells for future electric mobility product lines.

• Prologium Technology Co., Ltd.

A Taiwanese solid-state battery company developing solid-state batteries for automotive and smart devices scale in manufacturing.

This sample list includes a mix of established battery OEMs, automotive OEMs, and developmental start-ups that are competing across this hyper-growth business environment.

This key player list reflects the key market players that are focused on pushing the limits of the solid-state battery technology for application(s) and geography(s) based on the NextGen Intelligence Stats data.

Conclusion: Market Outlook to 2035

The explosive growth of the solid-state battery market that occurs throughout the forecast period is being driven by major shifts in mobility, electricity consumption and global sustainability goals.

Research that is proprietary to the company indicates an annual growth rate of 23.3% and indicative market size of over US$ 30 billion by 2035. Companies, investors and policy makers that can ride this technology wave will be important players powering up the future and providing safer, smarter, more reliable energy for a digitized, electrified world.

Discover Market Trends – Request a Complimentary Sample: https://nextgenintelligencestats.com/request-sample-report/69

Comments