Article Body

The global Cell and Gene Therapy Manufacturing market was worth USD 134.48 billion in 2024 and is expected to grow to USD 834.1 billion by 2035 at a CAGR of 15.5%.

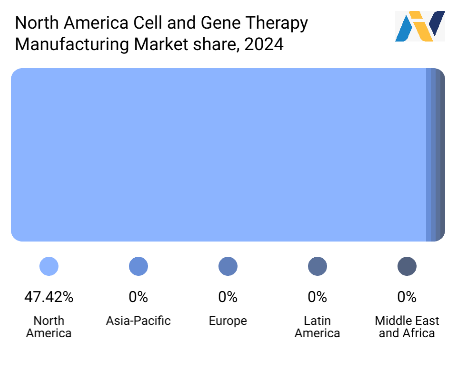

Regional Frontrunner

North America leads the Cell and Gene Therapy Manufacturing market, commanding the highest market share, which is around 47.42% as of 2024. North America's leadership is due to strong biotechnology & pharmaceutical industry, heavy investment in research & development, and a supportive regulatory environment. The US, in particular, leads the regional market with a high level of concentration of biopharmaceutical companies, research academic centers, and strong public and private sector funding. The presence of high levels of advanced clinical trials and early-stage regulatory clearance further extend North America's leadership role.

The Asia-Pacific region is expected to be the fastest-growing market in the Cell and Gene Therapy Manufacturing Market, with a notable compound annual growth rate (CAGR) anticipated during the forecast period. This is fueled by rising healthcare spending, increasing awareness of superior therapies, and government support initiatives in countries such as China, Japan, and South Korea. These countries are aggressively investing in building their biomanufacturing infrastructure and developing collaborations, with an ambition to be major players in the international cell and gene therapy market.

Market Overview

The report Global Cell and Gene Therapy Manufacturing Market Size, Share, Trends, Industry Analysis Report is segmented: By Therapy Type (Cell Therapy Manufacturing, Stem Cell Therapy, Non-Stem Cell Therapy, Gene Therapy Manufacturing), By Scale (Pre-commercial/R&D Manufacturing, Commercial Scale Manufacturing), By Mode (Contract Manufacturing, In-house Manufacturing), By Workflow (Cell Processing, Cell Banking, Process Development, Fill & Finish Operations, Analytical And Quality Testing, Raw Material Testing, Vector Production, Other Workflows), and Region, Market Forecast, 2025-2035 gives a detailed insight into current market dynamics and provides analysis on future market growth.

Cell and gene therapy (CGT) manufacturing is driven by a growing number of therapies and pipeline candidates approved, particularly for rare genetic diseases and cancer. As regulatory bodies accelerate approvals and offer frameworks such as the FDA's RMAT designation, demand for scalable and compliant manufacturing continues to increase. Booming biotechnology, such as CRISPR & viral vector technologies, also enables the development of new therapies, which require robust manufacturing capacity. Additionally, the development of personalized medicine & precision therapies has created a growing demand for flexible & scalable models of manufacturing. Contract Development & Manufacturing Organizations (CDMOs) are also taking a major role by providing end-to-end services, keeping infrastructure costs low, and enabling quicker time to market for smaller biotech companies.

Discover Market Trends – Request a Complimentary Sample: https://nextgenintelligencestats.com/request-sample-report/39

Key finding of the Report

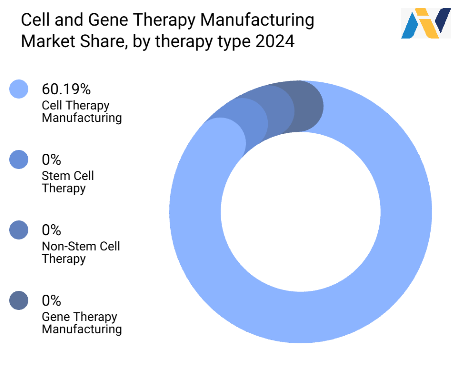

- The Cell Therapy Manufacturing market has the largest segment, with a strong market share of around 60.19% in 2024. This is because more cell therapy products have achieved regulatory approval and are further along in clinical development compared to gene therapies.

- The Gene Therapy Manufacturing segment is expected to lead global growth. This high growth is primarily attributed to the increasing number of gene therapy candidates advancing to late-stage clinical trials.

- The Pre-commercial/R&D Manufacturing segment had the largest revenue market share, accounting for nearly 73.34% in 2024. This is a result of the vast pipeline of cell and gene therapies under preclinical and clinical development.

- The commercial-scale manufacturing segment is anticipated to have the highest CAGR throughout the forecast period. This is being driven by the increasing approvals of cell & gene therapy products and their transition from clinical development to commercialization.

- The In-house Manufacturing segment is anticipated to exhibit the greatest CAGR throughout the forecast period. This is fuelled by educational centers with customized patient treatment protocols & large pharmaceutical companies with deep pockets.

Competitive Landscape

The key companies profile in the report are Lonza, Bluebird Bio Inc., Catalent Inc., F. Hoffmann-La Roche Ltd., Samsung Biologics, Boehringer Ingelheim, Cellular Therapeutics, Hitachi Chemical Co., Ltd., Bluebird Bio Inc., Takara Bio Inc., Others.

Comments